No audio available for this content.

From a weather perspective, Aberdeen, Scotland, may not be the most inviting location in the world in which to live. Nevertheless, Aberdeen is the leading European oil & gas business hub and is one of eight “super cities” spearheading the UK’s economy. But it’s waaaaay up north of the border with England on the east coast of Scotland — winter conditions can be difficult, even inhospitable at times. But if you want to transmit differential corrections out to shipping and oil rigs in the North Sea, it’s an ideal location.

Since its first beginnings in Aberdeen, Veripos has evolved to become a major worldwide business for marine, and now also for “precise land navigation, positioning and guidance solutions.” Veripos is now delivering augmentation services on a global basis, employs more than 130 specialist personnel based in 11 sites around the world, and in 2013 had revenues of more than $45 million. With a global ground network of more than 80 dual-redundant receiver base stations, Veripos now provides not only traditional differential GNSS transmissions, but also precise GPS and GLONASS orbit and clock corrections over seven Inmarsat GEOs and also via the Internet — we now call Precise Point Positioning (PPP).

Veripos began in March 1989 as a joint venture between Brown & Root Survey and Ormston Technology, a specialist marine electronics company based in Hull, England. Initially, Veripos provided a conventional Differential Global Positioning Service (DGPS) for users in the North Sea based on HF radio transmitters.

Introducing a much broader satellite-based DGPS service in 1994, coverage was extended to cover the Gulf of Mexico followed by further expansion of the network/coverage into Brazil, West Africa, Mediterranean and Caspian Sea. Veripos became a wholly-owned subsidiary of Subsea 7 in the same period. Following a major expansion in late 2004, full global service coverage was achieved in 2005, and ultimately Veripos became the second largest precise satellite positioning services supplier in the world to the marine industry, with leading clients in exploration, seismic, construction, survey, offshore supply vessels (OSV) and offshore drilling. In late October 2012, Veripos diversified further, launching its TerraStar business to address the land and near-shore sector.

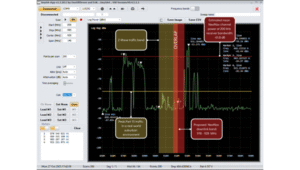

Achieving global accuracies of 5-10 centimeters using relatively small amounts of data, users worldwide are mostly able to accommodate the initial convergence time needed to achieve these higher accuracies. Veripos claims that using multiple constellations, convergence time can be down to less than 10 minutes — even lower for hot starts.

The “free” IGS data that competes with Veripos and other subscription correction providers is also pretty good, but it’s not generally used by commercial operations.

IGS data is provided by academic and government sources around the world, and the advantage is not only free access, but also open data and multiple open-source software tools and data, all built to published open standards. But the IGS system is not a 24/7 reliable data source, and support can be a problem. It’s not designed for companies who must have service guarantees in order for them to consistently operate profitably in difficult conditions — it’s more experimental, for research and testing for the academic and government outfits that produce the data, along with a whole bunch of engineering teams who take advantage of free data and can cope with system hiccups for their R&D and for comparison purposes.

So Veripos and other commercial providers overcome the weaknesses of IGS by providing a worldwide network that is well maintained — an infrastructure designed for high reliability and availability. Each base station has dual-redundant receiver and communications links. There are three processing centers, two active and one on warm standby, that can each operate the whole system, and each of the processing centers has dual-redundant equipment. There are seven geostationary satellites with a large degree of coverage overlap, and Internet data feeds also provide a backup. More than these system design features, Veripos works directly with its customers to ensure successful integration of their corrections with customer operations and, above all, supports the customer directly during these operations. If the customer is not operational, Veripos recognizes that down time means lost profits for its customers, so its staff work hard to avoid any service interruptions.

It’s not clear what would happen to this currently stable marketplace if and when Galileo begins selling a commercial service on E6, but the existing commercial service providers are pretty sure that competition in their segment from a government provider that is publicly funded is not in their best interests. At the recent Munich Satellite Navigation Summit, Gian-Gherardo Calini from the European GNSS Agency certainly received a clear message from Trimble, NovAtel, Veripos and Fugro (to a lesser extent) that these companies do not believe that Galileo should be entering their market. However, Calini did state several times that the GNSS agency did not want to disrupt this market. How to do that when the Galileo infrastructure, control systems and satellites are wholly government funded remains unclear. Even if the service were wholesaled to a commercial provider, it’s unlikely that the retailer would have to bear the full cost of maintenance and support of the entire Galileo ground and space infrastructure, so their service would in effect be hugely subsidized.

Veripos recognized that focusing on its marine service alone is ignoring the land segment. So the company established a new business called TerraStar to address the land segment, just as Fugro had spun off OminSTAR for the land segment many years ago. TerraStar is still a division of Veripos, and the PPP infrastructure and distribution system it uses is the same. TerraStar is focused entirely on land and close-to-shore operations, so its business development and marketing is aimed at wholesaling its services through OEMs for these segments, while Veripos continues in parallel solely with marine and offshore.

Initial OEMs to sign up were Septentrio and Altus, which is a subsidiary of Septentrio that focuses on survey products and applications. Septentrio had a number of successes with DEME dredging and land reclamation in Belgium and terrascan airborne geophysical survey in South Africa and Germany.

And here we arrive at the place where these companies all start to come together. In mid-March this year, Hexagon acquired Veripos, along with TerraStar. Hexagon is, of course, the parent that has NovAtel and Leica in its thoroughbred stable of GNSS industry leaders. Could this acquisition have something to do with John Deere/NavCom operating its own StarFire PPP system, or Trimble acquiring OmniSTAR from Fugro and now providing its own range of PPP correction services?

Well, NovAtel rolled out NovAtel Correct and new software at the end of March for its OEM6 high-precision receivers, which includes TerraStar’s precise point positioning (PPP) corrections. And NovAtel now has a closely associated company within the Hexagon stable, so a long-term association between NovAtel and Veripos/TerraStar is just about assured. And, with a big company group like Hexagon and many potential connections between group members with common interests, the prospect for continued investment as revenues increase means Veripos should be even better positioned going forward.

And, of course, adding NovAtel customers, including other potential OEM third parties, to the Veripos/TerraStar user base all helps both companies’ revenue and keeps their parent Hexagon happy too. So actually, it’s all about increasing the bottom line!

Now it all makes a lot of sense!

Tony Murfin

GNSS Aerospace

Craig Roberts

Tony, I do take issue with the suggestion that the IGS is somehow inferior and not reliable. I understand that it is a commercial service designed for specific markets, but in central NSW (most populous state of Australia)it is 800km to the nearest base station.

You mention “So Veripos and other commercial providers overcome the weaknesses of IGS by providing a worldwide network that is well maintained — an infrastructure designed for high reliability and availability. Each base station has dual-redundant receiver and communications links.”

The IGS has 400+ base stations. How many does Veripos have? If a station goes down on the IGS there is still 399+ backups.

“There are three processing centers, two active and one on warm standby,”

The IGS has 7 processing centres using different algorithms and combined solutions.

“There are seven geostationary satellites with a large degree of coverage overlap”

OK IGS is not a real time service…. yet… but some sites are.

How does Veripos handle coordinate dynamics (station velocities)?

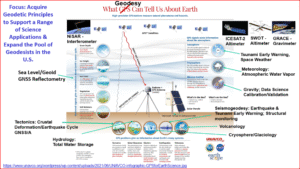

Don’t get me wrong, Veripos looks like a very good service for its clients, but please don’t bag the IGS which I liken to the United Nations of geodesy. Many good people and nations contribute (through their taxes which support infrastructure and personnel) to this service for the benefit of all.

Thanks for putting together this article. It’s good to know more about Veripos and I hope to try it out soon.

Craig

Eric Gakstatter

Hi Craig,

Good points. Have you used the IGS service yet? I’d like to give it a spin.

Eric

Craig Roberts

Hi Erik,

Not me personally but one of my students and some researchers have. You can download some open source software (there are a few options) and try it out. Early days for the RT IGS but results seem encouraging. Still the standard issues with initialisation times for RT PPP processing. We are also looking at the LEX message from QZSS which graces our shores thanks to the Japanese. Basically investigating near real time positioning options for remote locations in the absence of CORS networks and/or mobile phone coverage.

Cheers

Craig

Tony

Craig

No IGS bashing from me – IGS is a different tool of a different color. Point of the article is that if you want to run a business requiring PPP performance,you need to use a commercial service. If your application can stand some potential down time and tolerate longer initiation times – for university and engineering R&D for instance – IGS is perfect. Its free of charge and accurate and as reliable as you need. Good luck with IGS, its a great system!